how to calculate stock up rate

To do so subtract the original purchase price from the current price and divide the difference by the purchase price of the stock. Just follow the 5 easy steps below.

Enter the beginning earnings per share.

. For a company the cost of goods sold ie COGS is a yardstick for the production costs of services and goods. In the first case 100 multiply with 10 and get. For example assume that you want to calculate the change in price of the stock since you purchased it and the purchase price was 1150 per.

If you wanted the percentage of Products that had more than 100 items in Stock use. Future pricecurrent price1 years 1. At what rate the price will grow.

On each share you made a profit of 8 12-4. Formula for Rate of Return. How to calculate stocking rate and carrying capacity for cattle enterprises.

To arrive at this figure the stock calculator divides the total return on investment by the total original investment and then multiplies that result by 1N where N is the number of years the. Average Inventory 4341 billion. Calculating the rate of return for XYG is as follows.

Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100. Use Stock DaysAcre SDAs and divide by Animal Units AUs to calculate how many days to graze cattle on a pasture. P D 1 r g where.

It can be calculated using the below steps. Write down the beginning stock price. Average Inventory 4305 billion 4378 billion 2.

Select the time units you wish to use when entering the number of periods. Computing the future dividend value B DPS A. Substituting the values in the formula we get.

Access the price data and financial. The average stock needs to be. Search through the fields and located the section labeled.

Then raise this to the power of 1 divided by the number of years you held. Use this formula for growth rate calculation. For multiple years find the dividend growth rate for each year youre calculating.

The algorithm behind this stock price calculator applies the formulas explained here. For example if you brought 100 stocks of company A rate of 10 per stock and bought 200 stocks rate 15 per stock and so on. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at.

After doing that add them all up and divide by the number of years that you figured. Multiply by 100 to get the. Enter the ending earnings per share.

This takes your total investment to 4000. Find the historical prices section of the stock data. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling.

Take the percentage total return you found in the previous step written as a decimal and add 1. As per the above your. You can work out your average by counting the amount of products that are usually held in the warehouse during the.

It is important to calculate your safety stock carefully because. Pull up the stock info online or in the data youve downloaded. The formula used for the average growth rate over time method is to divide the present value by the past value multiply to the 1N power and then subtract one.

Multiply that figure by 100 to get the percentage. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. Finding the growth factor A 1 SGR001.

Multiply that by 1000 shares and your total profit is 8000. SUM CURRENT_STOCK 100 100 COUNT If you wanted the percentage of Products that had. Divide that total cost by the average of your inventory.

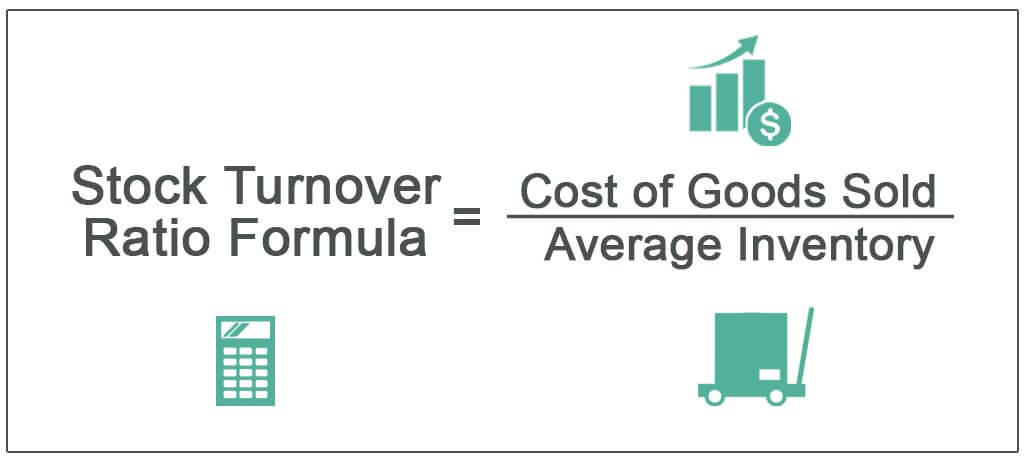

Average Inventory Inventory at Beginning of the Year Inventory at End of the Year 2.

How To Calculate Weighted Average Price Per Share Fox Business

Common Stock Formula Calculator Examples With Excel Template

Stock Price Calculator For Common Stock Valuation Budget Calculator Debt Calculator Mortgage Payment Calculator

Anticipatory Inventory Meaning Importance Advantages And More Financial Management Accounting And Finance Inventory

Pin On How To Calculate Total Shareholder Returns Tsr

How To Calculate Required Rate Of Return Finance Bullet Journal Business Process Management Finance Tips

Stock Turnover Ratio Meaning Formula Calculate Interpret

Best 5 High Return Shares 2021 High Cagr Stocks In 2021 Stocks With Cagr More Than 50 Investing In Stocks Stock Analysis Stock Market

Discount Rate Formula How To Calculate Discount Rate With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Interest Rate Formula Calculate Interest Rates Math Charts Opposite Words

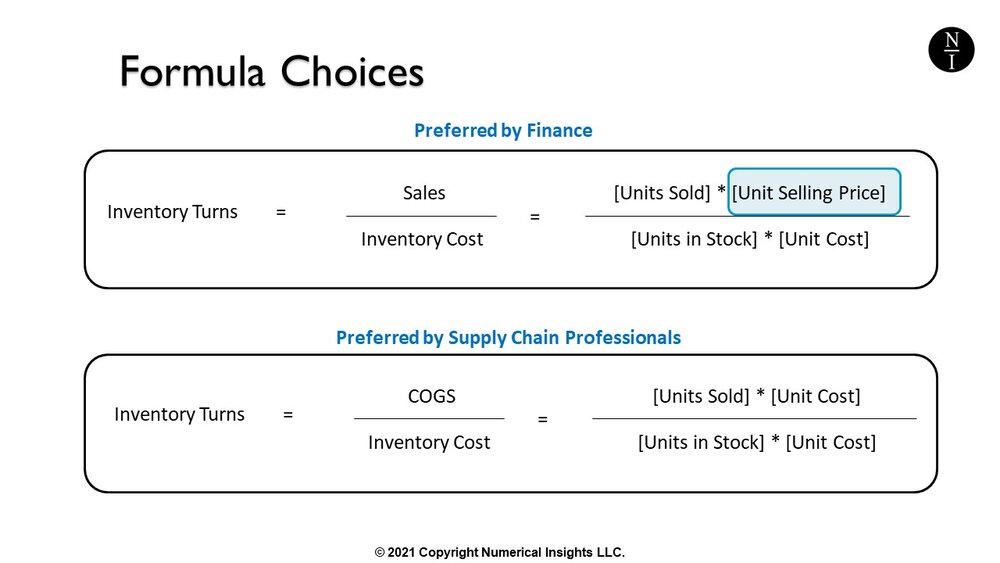

Formula To Calculate Inventory Turns Inventory Turnover Rate

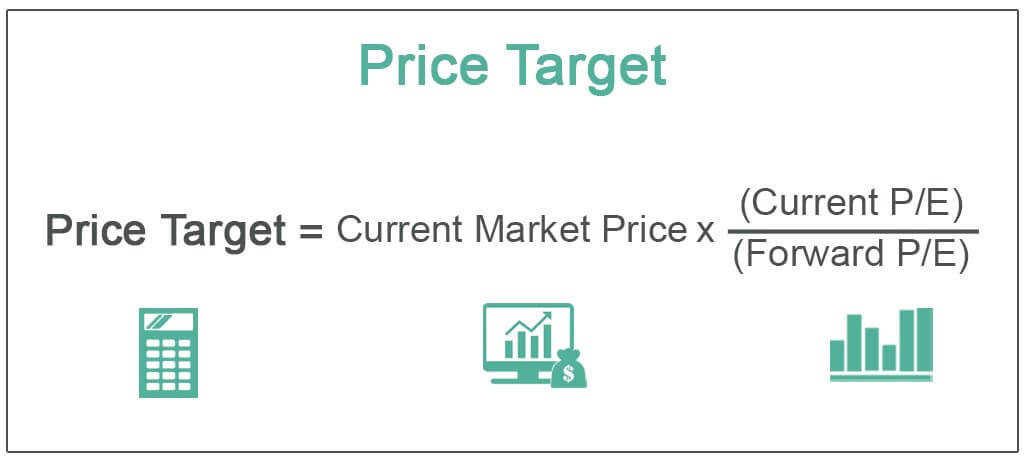

Price Target Definition Formula Calculate Stocks Price Target

Rate Of Return Formula Calculator Excel Template

Invest The Right Sip Amount Systematic Investment Plan Investing Investment Business Ideas

Intrinsic Value Formula Example How To Calculate Intrinsic Value In 2022 Intrinsic Value Intrinsic Company Values

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting